Welcome to Top Tips Tuesday. This week’s tip is for those property owners and investors, sitting on the fence and really not sure if now is the right time to invest in Australian Property.

We have all seen a lot of negative property news articles that are quite sensationalized.

Today I just want to give you an overview of a very good article I recently read by Michael Matusik.

Matusik does property reports and has been in the industry for many, many years and has seen lots of property cycles.

I really respect his views and opinions, and it’s all based on facts.

I would just like to summarize the article and most important facts I took from it.

The article is called Negative Property News Will Continue to Hasten in 2023. Here’s Why You Should Just Ignore It!

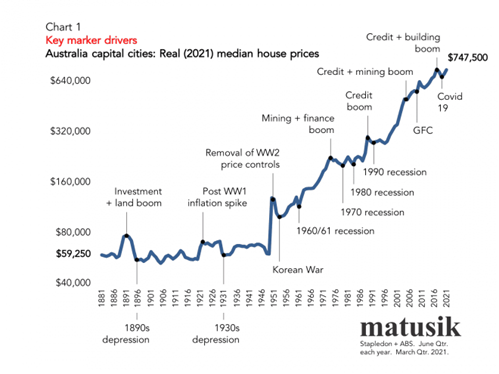

The above chart shows what has happened in the Australian property market since 1881.

As you can see from that chart there has been lots of instances that have really affected the property market. We’ve had World Wars, share market crashes, global recession etc.

Despite all those world changing events our property market still rebounded very fast after those events have finished.

Australian Property – Think Long Term!

That just shows that long-term property investment is very sound, and we just need to be a bit patient and look at the bigger picture, and the above chart really demonstrates that.

A recent article by the Australian Bureau of Statistics showed that buyers that have come into the market in the last three years are currently sitting on about 34% equity in their properties, which is quite a high percentage.

The major banks have just finished their financial reporting, and their estimates of clients that are ahead of their home loan repayments are at about 10 to 25%.

Another significant factor to consider since pre-Covid property values around Australia have increased by 42%.

The article also discusses negative gearing. So, what does negative equity mean?

It means that we owe more on the property than the property is currently worth. We hear a lot about this in the media.

Michael Matusik is estimating that only about 5% of Australian property owners have a loan worth more than the property value. Just because they have negative equity doesn’t mean that they’re going to default on their mortgage repayments.

The latest data shows that about 74% of mortgage owners still pay less than 25% of their total income towards their mortgage, which is quite a reasonable or smaller percentage.

And the real statistics are that Australians in more than 30 days of mortgage stress is down to 7% in the last quarter.

And it’s at the lowest level since the Fitch Ratings Index began in early 2002. So, what that means is only a very small percentage are currently under mortgage stress.

For the first time in over 10 years, we’ve got very low unemployment. We’ve got a genuine skill shortage of workers, and we are expecting to see very strong population growth over the next few years in Australia.

Australia’s population is currently just over that 25 million, as of March this year.

Recently the Australian government announced they have approved 195,000 Visa applications from overseas migrants coming into Australia over the next twelve months, which is a huge number.

And there’ll be a percentage of those that need to buy their own properties and there’ll be a higher percentage that will need to rent properties.

And our population growth is forecast to grow to 29 million by 2030, we are just under 26 million. So that’s a total population growth of 3 million people over the next eight years.

Those people will need to own or rent real estate, which is a very positive factor for Australian property investors going forward.

So that was just a bit of an overview of what’s happening based on real numbers and real statistics in the current market, and why those smart property investors are really taking advantage of the market right now.

I’m currently seeing fewer buyers in the market. Sellers are a bit more negotiable, so it’s actually a great time before the market goes up again.

I hope that’s helped in your decision-making. Have a great week. Thanks, and see you next week.

If you would like to discuss your property options further, you can book a time in my calendar by clicking here.

Regards,

Geoff Tomkins

Buyers Advocate

PH: 0404 852 781