This week’s tip is for those considering buying or investing in property, and really not sure if now is a good time with rising interest rates.

Sure, rising interest rates are a concern, but how is it going to affect the property price market?

I was reading an article over the weekend that was written some time ago. But it’s really relevant because it was when interest rates were about what they are now, around that 5.5% – 6% range.

The article was titled, ‘Do Rising Interest Rates Cause Property Prices to Fall?’ And it was written by Simon Buckingham.

The reality is we have seen rising interest rates over the last two or three years, which we are not accustomed to. But when you look back in history, we’ve had times when interest rates were much, much higher and property prices were still growing.

Historically have rising interest rates affected property Prices?

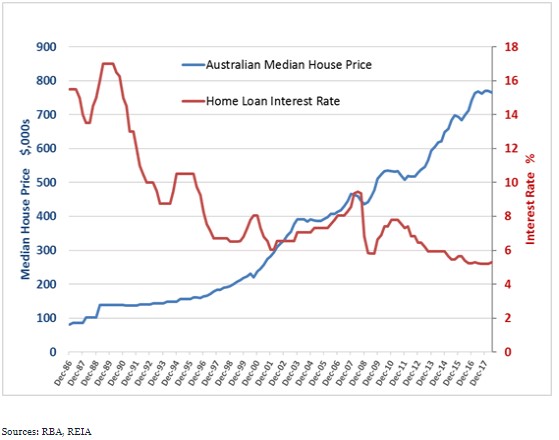

The chart above gives a bit of an indication of what has happened in the historical property market in Australia. The line in red is the interest rate and the blue line is the property price growth or medium price.

As you can see, going back sometime when interest rates were much higher than what they currently are, around 16% – 17%, property prices at the time were still growing quite strongly.

Interest rates have gone up and down over time, but the property market’s been pretty steady.

There have been years where the property market has dropped in value and hasn’t grown. But if you’re looking at the overall long-term trend it is very strong, regardless if the interest rates have been very high or historically low,

When interest rates were about 17% in the late eighties, and when the GFC come in 2008/2009, interest rates were 10%, which is much higher than what they currently are.

After the GFC, the government dropped the interest rates to try and stimulate the economy. At the time, it didn’t have a big effect. Property prices didn’t go up when they stimulated the low interest rate environment.

But what happened was when the economy started to recover, then we saw very strong price point growth.

Interest rates have one effect, but it’s only a small component in terms of property values and markets.

If we look back at history, we can use this as a bit of a guide. What’s going to happen in the future?

Between 1990 – 1993, we saw interest rates fall from 17% down to 9%. And the Australian property market did hardly change in medium values.

Interest rates are one component, but it’s not the only thing we could consider when we’re looking at property.

When we saw a sudden increase in interest rates in the year 2000 it didn’t affect the property market. And the property market in fact started to climb in value after 2000.

Personally, myself, I bought her my first property in New Zealand and interest rates were 20% at the time. But within 18 months that property had grown quite strongly in value.

If we’re looking to invest in property generally it’s a long-term investment and we should look at long-term trends overall.

The other things that will affect the property price market are supply and demand, vacancy rates, population growth, infrastructure, unemployment rates as well as interest rates.

The banks are already factoring in 3% above our actual lending rate when they’re assessing us for our borrowing capacity.

So when interest rates were around that 2%-3%, which was at historical lows, they were factoring in that we could actually afford to pay back that 5% or 6% interest rate, which has helped protect or insulate the Australian property market.

The other big takeaway point from here is it’s not one Australian property market.

When you see figures and statistics on the overall Australian property market, you need to really dive a bit deeper and look at those areas where you’re looking to invest.

We call that the property clock. What part of the property clock are those suburbs in which you are looking to invest?

For example, Adelaide’s in a very different position from Melbourne. Sydney’s in a very different position to Brisbane.

I’m currently in the Southeast Queensland property market and we’re seeing a real shortage of property. We’re seeing huge, interstate migration growth. And now we’re starting to see the international borders opening as well.

Next year we are going to see very strong population growth coming in from overseas, which again, we currently don’t have enough property to supply the demand. And that supply and demand is really going to have an effect on property prices.

Just one thing to keep in mind when you’re looking for that long-term property growth when making a decision.

So, my tip based on this article is to look back at history and the statistics when considering purchasing your next property. You this as a guide when making a decision on if now is a good time to purchase.

If you would like to discuss your property options further click here to book a time in my calendar.

Regards,

Geoff Tomkins

Buyers Advocate

PH: 0404 852 781