This week’s tip is for those investors looking to increase their rental return on an investment property.

The rental yields on new properties are not as strong now as they were previously due to the increasing interest rates.

There is another way we can increase that rental return and give us a much stronger cash flow.

These properties are known as co-living, and they have been designed to cater to the growing need of single individual people that need affordable accommodation.

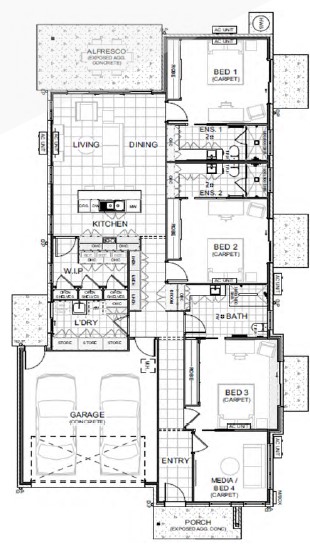

So, if we take a look at the floor plan, I can explain this concept in more detail.

This is known as a co-living property. As you can see from the floor plan it looks like a fairly traditional three bedroom, double garage with a two living area type property, but there’s some real big differences here.

You will notice that each bedroom has its own bathroom ensuite. What that means is we can lease these out to three individual tenants.

They are beautifully designed with a double garage and have storage facilities for each tenant as well.

They have common areas, so they can cook together and have that social interaction. But if they want to come home and just be on their own or study, they can have their own fully self-contained room.

With the high cost of housing in Australia and a competitive rental market, many people are struggling to afford housing. As our state grows and affordability reduces further, the co-living trend is becoming more attractive.

Rental return on a co-living compared to a stand-alone house

In this example we used a property worth around $700,000. If we leased it out on a traditional single lease arrangement, we probably rent the property out for somewhere around $600 per week.

However, if we rent it out as a co-living property on three separate leases, we can rent it out for about $250 to $300 per room, which gives us a weekly rental return of about $800 to $900. So that’s about $10,000 a year extra.

Covered in this rental figure is the tenant’s water, electricity, and water as well as furniture.

By renting it out this way, there is some other benefits as well. This type of property is not relying on any government funding so we can go out to the open market.

And also, we can still lease it as a single dwelling if we choose to.

When selling the property in the future, we can sell it as a traditional home with extra bathrooms. This is great for parents with teenagers or elderly parents that will have their own facilities.

These figures that I explained today are at the correct as of October 2022, these figures will change, depending on the property, the location, the rental income, etc.

If you like the concept and want to know what’s available reach out and we can discuss further. You can book a time in my calendar by clicking here.

Regards,

Geoff Tomkins

Buyers Advocate

PH: 0404 852 781