This week’s tip is for property investors and homeowners concerned about the recent changes to interest rates.

I know it’s on the lips of most people. There’s really a lot of misinformation as well.

Today I am going to cover some of the information that’s going to show it’s not actually as scary as what a lot of the media is saying.

You have probably seen in the media information about interest rates and what the RBA cash rate is doing. That is, the rate that the RBA will lend to the banks.

As we know, it has just recently gone up for the first time for many years, however it is still at the lowest it has ever been in a recent history.

The current RBA cash rate is 0.35%. Then on top of that, the banks need to make their profit margin, so they add their margin onto that cash rate. And that’s the rate that you or I will pay as homeowners.

We are currently paying the mortgage rate somewhere around that 2% to 3% currently.

A lot of information came out and a lot of really bad forecast about interest rates going up by 3% this year. This is simply not true.

Even the banks have recently reassessed anticipated rates by the end of the year, and quite dramatically reduced what they expected only two months ago.

Much like when COVID came out and these experts were talking about property prices dropping by 30%. They absolutely got it wrong. And a lot of property owners missed out by not buying property because of the misinformation out there.

The reality is interest rates will rise. So how is that going to affect the property market?

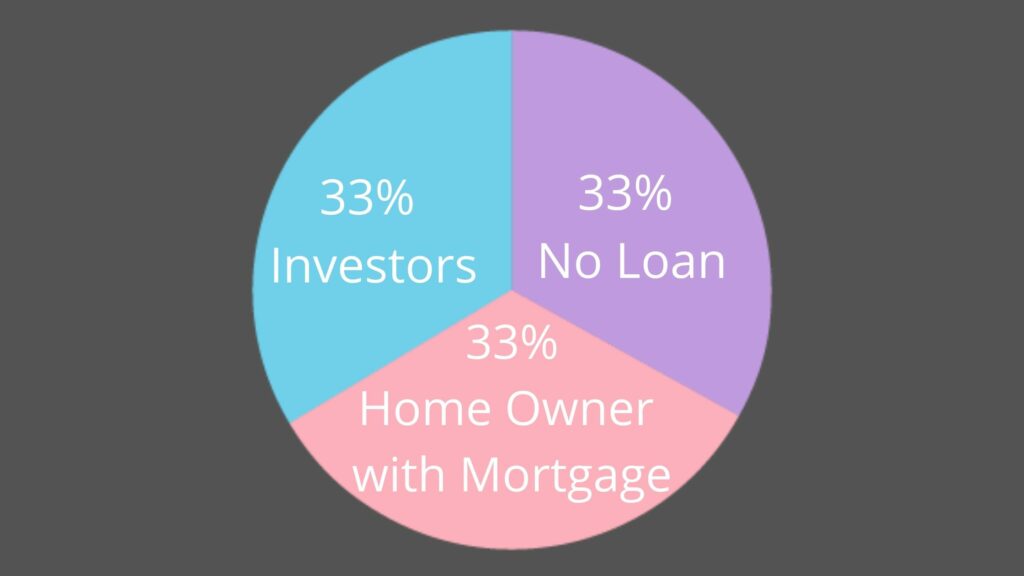

First, we need to look at how many homeowners or investors it is going affect.

In Australia, about 33% of homeowners own their properties without a mortgage. So, they’re not going to be affected by any of these interest rates.

A further 33% are property investors. Generally, when you buy a property for investment purposes, you’re buying a property for the longer term. So those short-term changes in finance rates aren’t going to affect you dramatically.

We know there’s a real shortage of rental accommodation and most property investors are seeing rental increases at the moment.

Their rental income is increasing, which is covering those interest rate increases as well. So, we’re not going to panic about those changes at the moment.

There’s a further 33% of homeowners that own their properties with a mortgage. These are the people that are going to be affected most by the interest rate increased.

There’s a lot of protection in place when applying for a loan.

The Australian banks have got very good credit ratings. Our Australian economy is going very strong.

When the banks lend you money, they are applying a repayment rate about 2.5% to 3% higher than we’re currently paying.

We can see that and confirm that by the rate of default loans in Australia.

The last statistic that came out in December 2021 showed the rate of default loans in Australia at just over 1.15%. So less than 2% were affected and needed to sell their properties as a stress sale. That’s a very small percentage.

If you found this information valuable and you would like to know more, we are coming to Sydney on the Saturday 25th June at 2:00pm to explain a bit more about interest rates, cash flows on properties, high income properties and much more.

It’s going to be at Rydges Parramatta. I would be great to meet you in person.

If you would like to register for the event click here.

Please fee free to share this with any of your friends that are in Sydney who you think would be interested in knowing more about the property market in Queensland.

Regards,

Geoff Tomkins

Buyers Advocate

PH 0404 852 781